- News

- Reviews

- Bikes

- Accessories

- Accessories - misc

- Computer mounts

- Bags

- Bar ends

- Bike bags & cases

- Bottle cages

- Bottles

- Cameras

- Car racks

- Child seats

- Computers

- Glasses

- GPS units

- Helmets

- Lights - front

- Lights - rear

- Lights - sets

- Locks

- Mirrors

- Mudguards

- Racks

- Pumps & CO2 inflators

- Puncture kits

- Reflectives

- Smart watches

- Stands and racks

- Trailers

- Clothing

- Components

- Bar tape & grips

- Bottom brackets

- Brake & gear cables

- Brake & STI levers

- Brake pads & spares

- Brakes

- Cassettes & freewheels

- Chains

- Chainsets & chainrings

- Derailleurs - front

- Derailleurs - rear

- Forks

- Gear levers & shifters

- Groupsets

- Handlebars & extensions

- Headsets

- Hubs

- Inner tubes

- Pedals

- Quick releases & skewers

- Saddles

- Seatposts

- Stems

- Wheels

- Tyres

- Health, fitness and nutrition

- Tools and workshop

- Miscellaneous

- Tubeless valves

- Buyers Guides

- Features

- Forum

- Recommends

- Podcast

feature

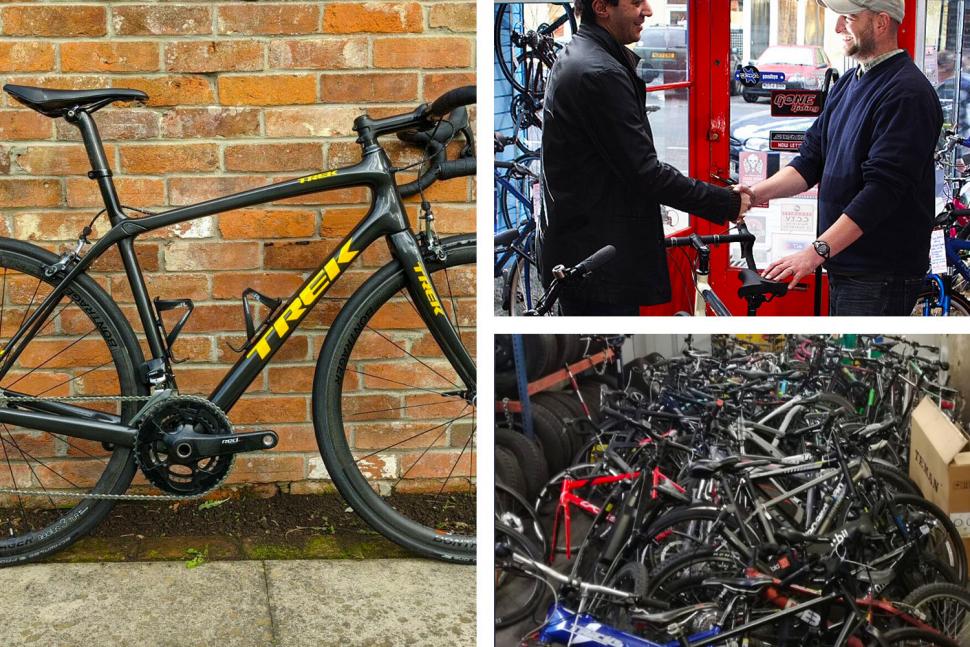

Your complete guide to buying a second hand bike Nov 2020

Your complete guide to buying a second hand bike Nov 2020Do new tax rules mean cyclists selling their bikes on eBay will now have to do a tax return?

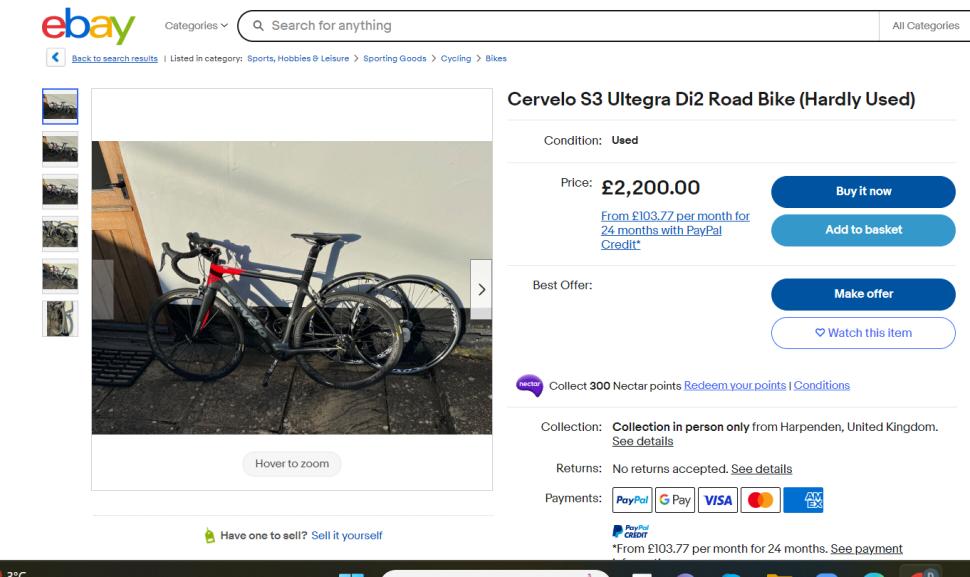

2024 began with the news that digital platforms such as eBay, Etsy and Vinted will now have to collect extra information about the people who sell using their websites and apps and share it with HMRC, sparking concerns among sellers, side-hustlers, and New Year garage-clearers that they could end up paying more tax, or at least have to spend time and effort on a self-assessment tax return.

Rumours (incorrectly) spread online of a new tax for people using re-selling sites to earn a bit of money on the side and, with such a busy second-hand market for bikes and components, some may have been left wondering if this applies for those of us using the internet to clear our wardrobes of those old jerseys, and occasionally maybe even selling a bike or two.

The bottom line is there is no new tax. As it was before, online sellers have a £1,000 annual trading allowance from selling personal items, and only after exceeding that will tax need to be paid on profits; the key word here being 'profits', i.e. if you're selling a bike for less than you paid for it (or potentially more, but didn't sell with the intention of making a profit) then this doesn't apply to you, even if you've sold a bike for considerably more than £1,000.

> Your complete guide to buying a second hand bike

What has changed, however, is that HMRC will now be getting more information, such as how many sales a user has made, from websites and apps to more easily identify people using the platforms who will need to pay tax on profits exceeding £1,000.

This information-sharing used to be accessed from online platforms by HMRC when required, now it will be automatic and also includes overseas platforms.

We spoke to Nadia Price, an accountant at Link Stone Advisory, for the full rundown...

"HMRC's new visibility into online marketplace receipts may be giving a few people qualms about selling on possessions in places such as eBay or Facebook," she said. "Realistically, though, as long as you have good records, there should be nothing to worry about.

"HMRC has not been given any new tax-raising powers, just an increased level of insight to highlight where it should be asking questions, in case people have made more than £1,000 trading income.

"They are particularly looking for individuals carrying on a trade — this is more significant than the occasional sale or purchase, and is likely to be associated with regular transactions, the intention to make profit, or a short period between buying and selling items.

"HMRC has nine of these so-called 'badges of trade' but they are very much common sense. Clearing out your attic for the first time in ten years, even if you make more than £1,000 on that occasion, will not be trade. Filling your garage with bric a brac regularly at car boot sales and then clearing it out every six months or so, is much more what HMRC is looking out for.

"You may happen to sell a very expensive item (sales proceeds over £6,000), in which case you would also need to consider whether you should pay Capital Gains Tax. Capital Gains Tax only applies if you made a profit on the item, and personal possessions, including machinery, with an expected life of under fifty years are also excluded. Note the 'personal', though — as soon as you have used an item in your business (e.g a camera) — it's chargeable.

"As with all potential dealings with HMRC, make sure you have kept good records of when you bought and sold items and for how much. HMRC has a useful link for you to check whether you are likely to need to pay tax on additional sources of funds: check if you need to tell HMRC about additional income — GOV.UK (www.gov.uk). And as always if something is particularly large or unusual, it is well worth taking specific professional advice."

According to Martin Lewis's MoneySavingExpert website, firms will only pass on data to HMRC automatically if users are selling 30 or more items a year or have total earnings over the equivalent of €2,000 (£1,720). Of course, if you are making more than £1,000 a year from selling then you may still have to pay tax on profits exceeding that, regardless of if you meet that threshold for data being automatically passed on.

To conclude: no, you don't have to worry about doing a tax return if you're planning to sell your bike. If you build bikes up to sell for profit and that profit totals more than £1,000 a year then it's a different matter, but anyone in this business will most likely already know that their profits are taxable. If you regularly buy bikes and gear and sell them on when you no longer want or need them, it's a good idea to keep records of your original purchases just in case the sales are ever queried.

Dan is the road.cc news editor and joined in 2020 having previously written about nearly every other sport under the sun for the Express, and the weird and wonderful world of non-league football for The Non-League Paper. Dan has been at road.cc for four years and mainly writes news and tech articles as well as the occasional feature. He has hopefully kept you entertained on the live blog too.

Never fast enough to take things on the bike too seriously, when he's not working you'll find him exploring the south of England by two wheels at a leisurely weekend pace, or enjoying his favourite Scottish roads when visiting family. Sometimes he'll even load up the bags and ride up the whole way, he's a bit strange like that.

Latest Comments

- chrisonabike 11 min ago

Yup - trail (officially) gone cold. It may just be because the courts work in their own sweet time. It may...

- chrisonabike 15 min 14 sec ago

Perhaps they've given up wearing platform shoes?

- super_davo 16 min 19 sec ago

Jeez you're all cynical... ...

- peted76 25 min 20 sec ago

I have this light, I agree with every point made, it's a good solid light that's overkill for 95% of it's use (good for taking the dogs out for a...

- aramando 33 min 19 sec ago

Come on, this cannot be the first time you've seen percentages used like this? Percentages are just a way of expressing fractions/decimals on a...

- Jimmy Ray Will 57 min 7 sec ago

The scary thing with these robberies is that they are clearly being orchestrated by intelligent, dilgent thieves. ...

- stonojnr 1 hour 34 min ago

I'd agree paint is the worst option for infra, but we used to have a busy road that had just paint as a cycle lane. It wasn't great, far from it,...

- MR P H SMITH 2 hours 11 min ago

@mtbtomo We're stoppping at Fodele Beach this Summer! I trust it was a good hotel? Moreover, I've booked my bike and would love to know if you have...

Add new comment

17 comments

If you sell it for a loss you might be able to put in for a tax rebate.

It's ok... It's only applicable if you make a profit selling the bike on what it actually cost. Not what you told your partner you paid for it!

Are you regularly buying and selling bike bits to try and turn a profit? You're probably trading, so profits are charged to income tax.

Are you clearing out some bike bits you've accumulated over the years? You're probably not trading. The bits will probably be exempt from CGT as "wasting assets" (expected lifespan < 50 years) so gains aren't taxable and losses aren't relievable.

My ex wife regularly buys stuff at car boots then sells on ebay for a profit. Its people like her that HMRC is after. I doubt she makes more than £1000 though, but there are plenty on ebay and elsewhere who do.

And a good thing too, I pay my taxes, so should everyone else.

PS, not paying tax in this instance would be evasion (illegal) not avoidance (immoral).

None of these rules are new, it's just the visibility that HMRC have over online sales platform activity that has changed.

Unless you are selling items for a profit, there's no issue. Also, for those who are trading, trading profits below £1,000 will be non-taxable.

So is a new bike tax deductable now HMRC?

Seems like they are double dipping on this one. As the purchase would have been out of income that was already income taxed.

By that logic income tax should be the only tax one pays, why should I pay alcohol duty or VAT when I've already paid tax on the money I'm buying my beer with? It would be lovely if that were the case (from a personal finance point of view) but as income tax only makes up roughly 25% of government income I think we might be in a bit of a pickle if we start to apply that principle.

unless you were selling at a profit. in which case purchase could have been out oif the profits from previous bike sales.

you see where this is going right? having a "side hussle" of buying bikes and selling them for more is subject to tax (on the profit).

buying a bike, using it for 2 years and then selling it for purchase price or less is not a profit and not taxable, just as no one pays tax when selling their used cars. (unless they are buy and selling cars for a profit). there is no double dipping here.

I've got about 40 framesets, 50 seatposts, 50 stems, 50 pairs of wheels etc, all accumulated over the years. I have no 'records', having bought them from many different sources. I buy and sell different bits all the time. I buy good kit when times are good, and sell when things are tight.

It'll be interesting to see what HMRC asks me for when they see my eBay sales for 2024. Last year I sold a frameset I'd owned since 1990, but no proof of that, of course.

Somewhere in the depths of HMRC...

"We need to look at tax avoidance on the digital commerce platforms, I mean, as an example, in 2019, eBay paid less than £10m tax on £1b revenue."

"What, you mean implementing some kind of internationally agreed service tax to circumvent these complex cross-border avoidance schemes?"

"Something like that yes."

"Fuck that, it's way too complicated. Bob in Arbroath has just sold some bike parts on eBay, get an SA100 off to him now."

Brilliant

Important to note very clearly that this is profit, not revenue/proceeds. Unless you've scored a great deal on a bike you're unlikely to make a profit selling it, particularly in the current market. I think it's more likely to catch people selling fashions/trainers - I made a few hundred quid on selling 90s retro gig tees last year for example.

Can I count all the stuff I've sold as a loss against tax ;-> Usually I'm selling stuff for much less than I paid

I was wondering that too. I guess you would have to be registered as a sole trader for your business losses to be offset against your total tax bill. Perhaps someone with more knowledge could comment?

More on the trading allowance - you don't need to be a business, it covers any casual income

https://www.litrg.org.uk/tax-guides/self-employment/what-trading-allowance

Yes, providing you have records.

Easy enough to generate a loss too - e.g. sell an item on the platform on a low buy it now to a family member/friend

If trading, then a loss can be offset against other income, but you have to be trading "with a view to profit".

Therefore most likely not trading. A capital loss can be set against other capital gains in that tax year or future years, not against income. But this won't apply to bikes as these are almost certainly "wasting chattels" (expected life < 50 years) and so are exempt from CGT.